without opening a legal entity — we’ll manage payroll, benefits, taxes, and compliance

Hire and Pay Your Employees outside Canada

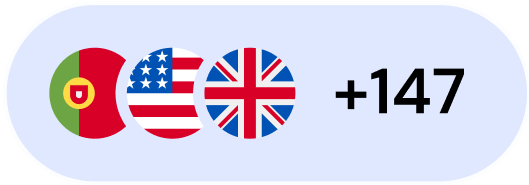

Some of our clients’ teams spread across three continents and over 35 markets

CTO, N Technologies

Gintautas Kišonas

David Peterson

CTO, PebblePost

You should expect above-average service. They’re professional and place a high value on customer service.

...their work ethic is great

The GEOR team was essentially an extension of our team

They found highly skilled engineers to manage core project goals, supporting the development of a scalable and reliable platform.

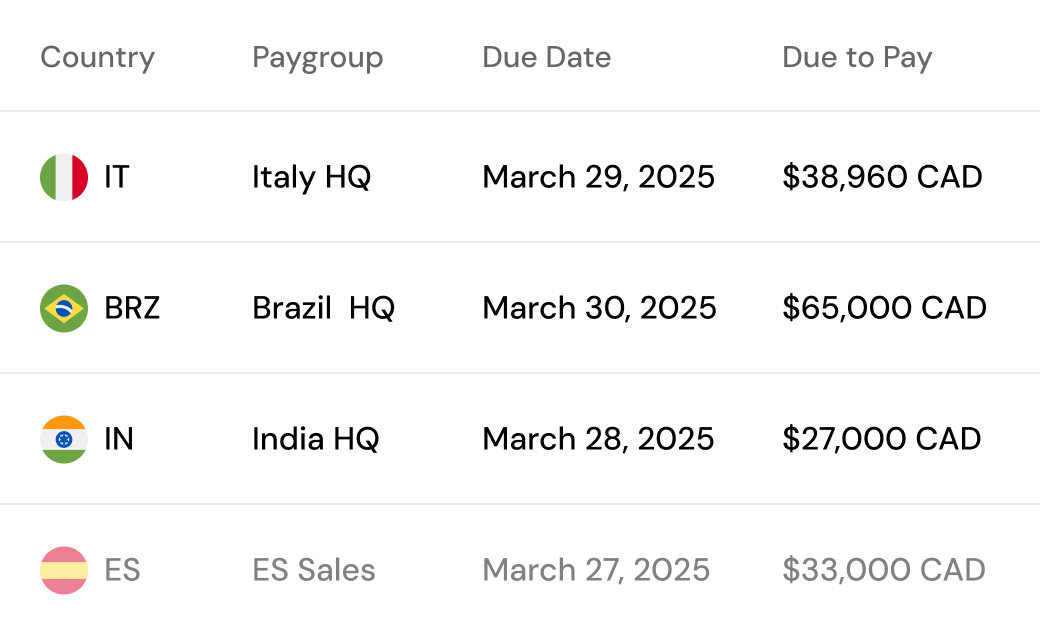

Streamline payments for your own legal entities, through our legal entities, or both

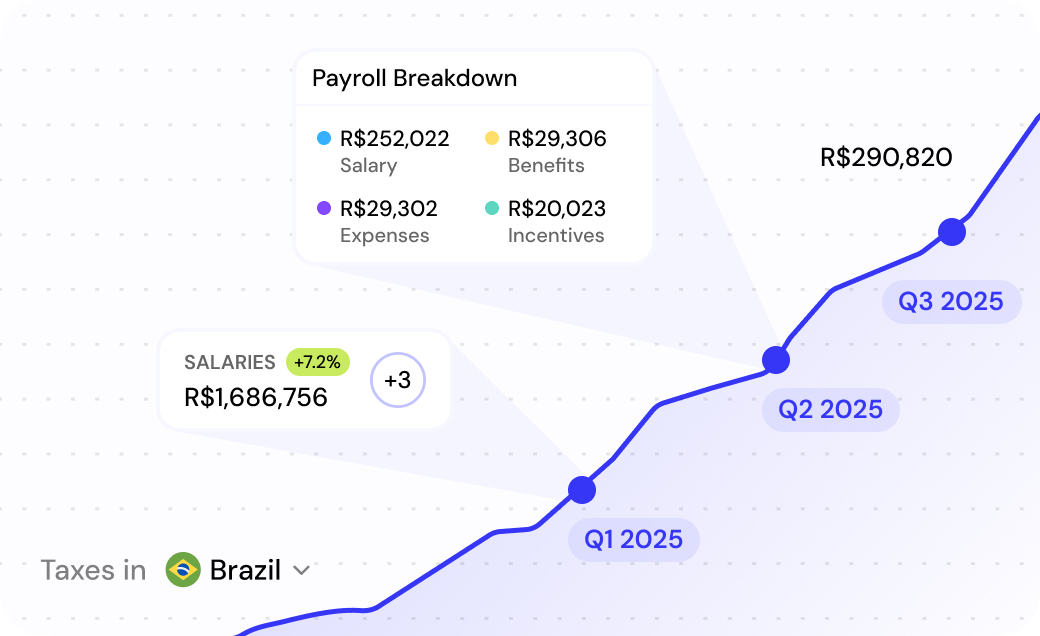

Consolidated multi-country payroll

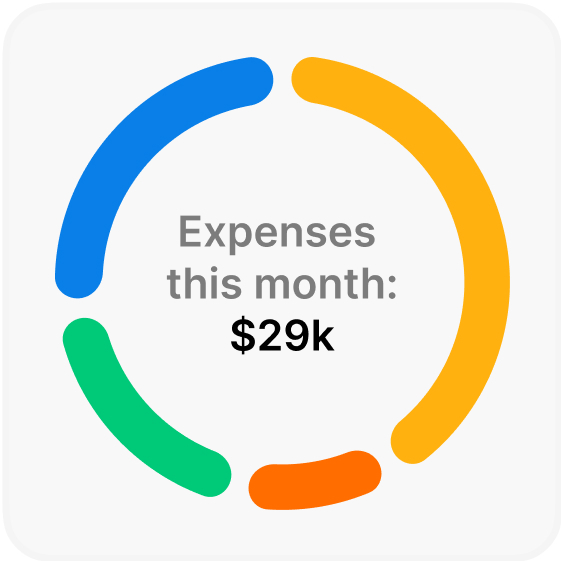

Global payroll reporting and analytics

Compare employer costs, bonuses, taxes across your entities

150+ countries, one platform for all things payroll

Benefits, deductions, payslips, local filing with authorities, salary, taxes, onboarding, localized contracts, offboarding

Skip months of setting up local entities — use ours to onboard employees fast

Hire in new countries within 7 days

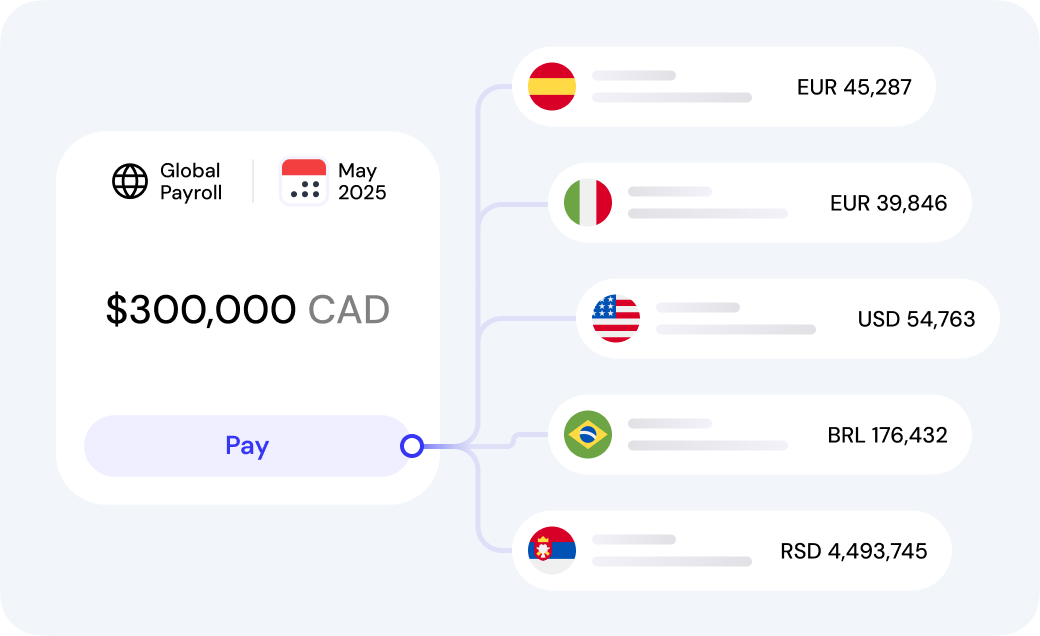

One payment, multiple currencies

Send a single payment — we handle payouts in local currencies for your entire team

handle tax, permits, and stay up-to-date with local laws —

so you don’t have to

so you don’t have to

Our team of 50+ payroll and legal experts

100% compliant with any local labour law

Ann Smith

Payroll Manager for the UK

Once hired 50 employees for our client in just 2 months

Ann Smith

Payroll Manager for the UK

Once hired 50 employees for our client in just 2 months

10+ years experience in HR, Legal & Executive assistance

HR Administrator

Olga Targonskaya

Once hired 50 employees for our client in just 2 months

Project Manager

Anastasia Sakatkova

Ann Smith

Payroll Manager for the UK

Once hired 50 employees for our client in just 2 months

Ann Smith

Payroll Manager for the UK

Once hired 50 employees for our client in just 2 months

Once hired 50 employees for our client in just 2 months

Payroll Manager for the UK

Ann Smith

Once hired 50 employees for our client in just 2 months

Payroll Manager for the UK

Ann Smith

Payroll Manager for the UK

Once hired 50 employees for our client in just 2 months

Ann Smith

Payroll Manager for the UK

Once hired 50 employees for our client in just 2 months

Once hired 50 employees for our client in just 2 months

Payroll Manager for the UK

Ann Smith

Once hired 50 employees for our client in just 2 months

Payroll Manager for the UK

Ann Smith

Anastasia Sakatkova

Project Manager

Once hired 50 employees for our client in just 2 months

Olga Targonskaya

HR Administrator

10+ years experience in HR, Legal & Executive assistance

Once hired 50 employees for our client in just 2 months

Payroll Manager for the UK

Ann Smith

Once hired 50 employees for our client in just 2 months

Payroll Manager for the UK

Ann Smith

Ann Smith

We handle the complex stuff — you stay in control

Our team manages compliance, payroll, and local laws. You hire talent, approve payments, and manage it all from a simple dashboard

Helping you scale globally since 2010

Headquartered in Alexandria, Virginia, we support you on all your employee needs, from recruitment to management

IT recruitment services

We quickly pair your up with over 50,000

pre-vetted top-row IT experts from our database

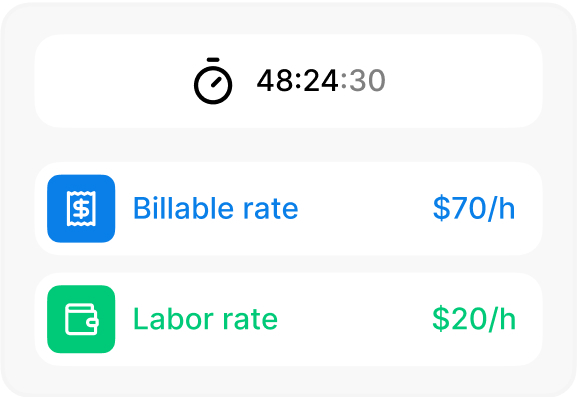

Time tracking, absence and expense management, local work calendar,

and much more

Employee management

Hire employees internationally without setting up entities

EOR Services

per employee a month

Learn the pricing for your company

– Legal employment in 150+ countries

– Local tax, payroll, and labor compliance

– Fast employee onboarding

– Centralized payroll and benefits management

– Ongoing payroll and legal support

– Local tax, payroll, and labor compliance

– Fast employee onboarding

– Centralized payroll and benefits management

– Ongoing payroll and legal support

$499

Hire and pay employees globally

without setting up local entities

FAQs

Small businesses in Canada can manage payroll either in-house or by outsourcing to specialized service providers. In-house payroll requires compliance with both federal and provincial regulations, including Canada Pension Plan (CPP) contributions, Employment Insurance (EI), and income tax withholdings. A service like GEOR can simplify the process by managing payroll, tax withholdings, and benefits administration, ensuring full compliance with Canadian laws.

A payroll company handles salary payments, tax withholdings, CPP contributions, EI premiums, and benefits administration. It ensures compliance with local labor and tax laws, files taxes with authorities like the CRA, produces payroll reports, and can disburse salaries in local currencies for international employees. These services reduce administrative burden and compliance risk while ensuring employees are paid accurately and on time.

Payroll calculation involves determining gross salary and subtracting applicable deductions, including federal and provincial income taxes, CPP contributions, EI premiums, and any province-specific mandatory deductions. GEOR ensures payroll is handled in full compliance with local regulations, offering accurate and timely processing and relieving businesses from the complexity of Canadian tax and labor requirements.